The high economic growth of Turkey which has been going on for more than a decade now intensified Turkey's need for more energy. It is estimated that Turkey is going to need a substantial volume of energy which will amount to a 7 % annual growth for the Turkish energy market until the year 2023. The total amount of investment that is going to be needed in order to cover Turkey's needs for energy by 2023 is USD$ 120 billion. In order to secure the necessary amount of energy to cover the needs that high economic growth dictates, Turkey needs to diversify its energy suppliers and secure the stable flow of oil and gas that its industry needs. In order to do so Turkey has taken the decision to transform itself in to an energy hub.

The advantage that Turkey's geographical location poses for the country is a well-known fact. Turkey is strategically located in between Asia and Europe and perfectly serves as a transit route for energy due to its proximity both to the energy suppliers and to the consumers. Upon their completion Turkey is expected to house 13 different natural gas and oil pipelines passing through its territory in the short to midterm. Once and if completed the proposed projects of Arab Gas pipeline, Nabucco pipeline, Qatar-Turkey pipeline and Trans-Anatolian pipeline (TANAP) will turn Turkey into major energy corridor.

The Issue of Diversification and the New Opportunity in the Eastern Mediterranean

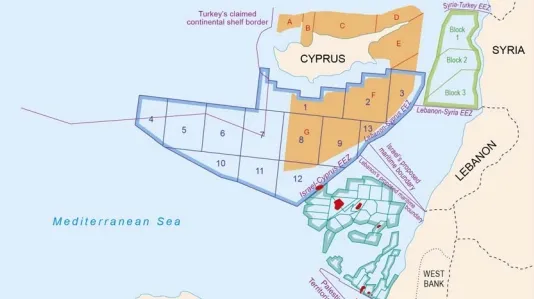

The discovery of new oil and gas fields in the Eastern Mediterranean provides a newfound opportunity for Turkey to diversify its energy suppliers. Especially the discovery of the Leviathan gas field which is considered as one of the largest off shore gas findings of the decade is an important opportunity for all the countries in the region including Turkey. The numbers will reveal why the discovery of this well might be a game changer in the energy politics of the region. The Leviathan well is considered to house 25 million cubic feet of natural gas and more than 600 million barrels of oil.

When these numbers are combined with the additional gas reserve which is estimated to be around 220 billion cubic meters in the Tamar gas field, it is self revealing that the region will soon serve as one of the most important suppliers of energy in to the world markets. Turkey, by its very geographical location, is one of the most important candidates to serve as a transport route for the conveyance of the gas and oil extracted from the Easter Mediterranean to Europe. Moreover, the existence of gas pipelines for years inside the Turkish territory has already provided Turkey with the labor force which has the necessary technical expertise to maintain and repair the pipelines and the related facilities. Apart from the geographical position of being located in close vicinity of hydro-carbon consumers and producers and having obtained the necessary expertise for maintenance, size of the Turkish market itself makes Turkey an indispensible partner to parties involved in the Eastern Mediterranean gas fields.

EPİAŞ

On the one hand Turkey exploits its location, market clout and expertise to serve as an energy hub and on the other hand it takes the necessary measures to ensure the energy price stability that such a role requires. In this regard the boldest step that has being taken by Turkey is the establishment of EPİAŞ which is going to serve as an energy exchange to stabilize the prices. The Electricity Market Law points the second quarter of 2014 for the establishment of the exchange and institutions will be jointly owned by the Istanbul Stock Exchange (Borsa İstanbul), private sector players and the Turkish Electricity Transmission Company (TEİAŞ)to ensure investors' confidence. Once it is established Turkey will an energy market with more foreseeable and stable prices that can fuse its geographical advantage, technical expertise and market scale with investor confidence.

LNG Market in Turkey

Currently, the importance of the Liguefied Natural Gas ("LNG") has come to the fore with the discussions concerning the probable problems in natural gas import to the Europe due to the Crimean Crisis. According to the experts' opinion, the LNG import to the Europe may increase in the near future depending on the decrease of the natural gas import. In brief, the LNG plays an essential role as an energy resource.

LNG import in Turkey

LNG import has been enabled in Turkey within the frame of the amendment on the Natural Gas Law in 2008. As is known, the LNG is regarded as an alternative energy resource to the natural gas and provides advantages such as its harmfulness to the environment and ease of its handling and storage. LNG import has been regulated as a market activity by the Natural Gas Market License Regulation and Natural Gas Market Law. Accordingly, the import, storage and trade of the LNG is subject to specific licenses and permits. Pursuant to the Natural Gas Market Law, these market activities may be operated by private sector companies within the scope of opening of the natural gas market to competition. License application processes have been set forth by the Natural Gas Market License Regulation.

Turkey supplies its LNG mainly from Nigeria and Algeria. According to the statistics of the Energy Market Regulatory Authority ("EMRA"), 7.862 million cubic meter of LNG have been imported in 2012 which corresponds to 17 % of the total natural gas import of Turkey. Even if the natural gas market has been opened to the competition, LNG import activities have been operated by BOTAŞ to a large extent.

Why operate in LNG sector? LNG incentives

There are several facilities for LNG license applications provided by the recent Natural Gas Market Law. For example, the license application evaluation process takes 30 days for LNG import license applications whereas this term has been regulated for natural gas import license applications as 60 days. Moreover, the spot LNG import has also been supported with increase of license requirements. Pursuant to the Natural Gas Market Law and License Regulation, storage capacities, information and guarantee regarding the imported natural gas, capacity to contribute to the national transmission system are not required for spot LNG import license applications and spot LNG import license provides the possibility to the license owners operate with one license in more than one import grids.

Not only above mentioned facilities, but there have also been financial incentives proposed about LNG plants in 2013 in order to increase the LNG investments in Turkey. In the event that these incentives are regulated by the New Natural Gas Market Law, the LNG storage facility investor will be entitled to obtain LNG from this facility as much as he/she needs, the investors may benefit from the financial incentives and these investors may determine the tariffs of usage of the LNG plants by third parties. Currently, these incentives have not come to the fore yet and they are regarded as a proposal.

Incorporation of an LNG company in Turkey

It is possible that foreigners set up a company in Turkey independent of their nationality and the company type planned to be established. Anyone who intends to operate in LNG market shall consider the specific requirements which have been stated in the natural gas laws and regulations such as the terms which shall be regulated in the articles of association, the minimum capital amounts which have been determined for each market activity.