The growth of the Turkish economy in unprecedented rates during the course of the last decade have generated a strong demand for consumer goods. Especially the significant jump not only in Turkey's GDP per capita but in its disposable income came to create such a demand for the retail sector products. Per capita disposable income in Turkey in 2012 stood around US$ 7700 and it is expected to grow by 50% during the following five-year period.

Given such positive expectations with regard to disposable income levels which always serves as the back bone of the retail sector, it is no surprise to see the retail sector booming in Turkey. The sector is expected to grow even further in line with the expectations of growth of the Turkish economy. The size of the retail sector was recorded as US$ 300 billion in 2012 and it is expected to record around a 10% growth for the next five years. Especially the staggering increase of the number of total shopping malls all around the country which have exceeded 300 in 2012 contributed to this growth of the retail sector. The latest stats dating back to November 2013 and issued by Turkish Statistical Institute revealed that the retail sales volume increased by 4.5% in August 2013 compared to the previous month. However, such picture of growth is only one side of the story.

The Challenges and the Pitfalls

Even though the sector has been in full swing during the course of the last ten years, there are some problems that needed to be addressed. The current account deficit that has reached alarming numbers by the end of year 2013 combined with historically low levels of saving rates to create a fragile state for the Turkish economy. As a response, economic authorities have recently taken the decision to rein in personal spending and increase the level of saving rates to redress the issue of high current account deficit. In line with this effort, a recent regulation has been made to limit the credit card usage and specially to restrict the number of installments in many of the consumer goods. This is where the problem starts for the retail sector which heavily depends on consumer appetite for spending and credit card usage. Especially the extended periods of installments and discounts provided by the banks have been instrumental for such growth in the sector.

The Need for a New Regulation

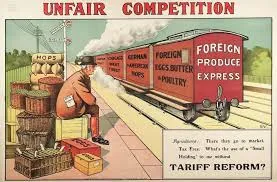

The representatives from the retail sector have recently made their demand for a new regulation public. The problems that they would like to address with the new regulation that they are seeking are the issues related with strategic planning for the right location, working hours and days to attract better educated and qualified workforce and unfair competition. Especially the issue of unfair competition continues to be a significant challenge for the sector. Due to the absence of a clear regulation dealing with the issue many wholesalers get involve in retail business by their own arbitrary sales strategies. This leads to unfair competition as well as VAT loses for the treasury.